Getting into the World of Equity in Finance

If you’ve ever delved into the world of finance, chances are you’ve come across the term “equity.” It’s a buzzword in the financial realm, often thrown around in conversations about investments, stocks and company valuations. But what exactly is equity in finance and why does it matter?

Let’s break it down in this comprehensive post, using real life examples to make the concept crystal clear.

Equity, in the realm of finance, is essentially ownership. When you own a piece of something, be it a company or an asset, you hold equity in that entity. In the stock market, equity is often synonymous with shares or stocks – owning shares of a company means you have a stake in its equity.

One of the fundamental concepts to grasp is the dichotomy between equity and debt. Equity represents ownership while debt is a form of borrowing. Imagine you’re starting a business and you need capital. You can either sell shares (equity) or take a loan (debt). The key difference lies in ownership – equity implies sharing ownership while debt is a commitment to repay borrowed money.

Now, let’s waltz into the vibrant world of the stock market. Publicly traded companies offer shares to the public allowing individuals to become shareholders and partake in the ownership of the company. Apple, for instance, has millions of shareholders, each holding a slice of the equity pie.

Market capitalization or market cap is a metric investors often use to assess the value of a company’s equity. It’s calculated by multiplying the current stock price by the total number of outstanding shares. Think of it as the price tag on the entire company – the sum of all its equities.

Picture this scenario: You’re an early investor in a startup and the company decides to raise more capital by issuing additional shares. This is where the concept of dilution comes into play. Your ownership percentage decreases because more shares are in circulation. On the flip side, if the company performs well, the value of each share appreciates, potentially offsetting the dilution effect.

In the equity landscape, common and preferred shares take center stage. Common shares represent basic ownership, often entitling shareholders to vote on certain company decisions. On the other hand, preferred shares come with additional privileges, such as priority in dividend payouts and liquidation.

Dividends are the sweet rewards of holding equity in a dividend paying company. Picture it as your share of the profits. Companies with robust financial health often distribute a portion of their earnings to shareholders in the form of dividends. It’s like receiving a paycheck for being a loyal equity holder.

Ever wondered why employees in startups are often granted stock options? It’s a strategy to align their interests with the company’s success. Employee equity programs allow workers to own a piece of the company, fostering a sense of ownership and motivation to contribute to the company’s growth.

While the stock market showcases equity on a public stage, private equity operates behind closed doors. Private equity firms invest in private companies, often aiming to revamp and later sell them for a profit. Investors in private equity funds become indirect owners of various companies within the fund’s portfolio.

Equity isn’t exclusive to the stock market. In real estate, equity manifests through property ownership. If you own a house with a mortgage, your equity in the property is the difference between its market value and the outstanding mortgage. As you pay off the mortgage, your equity stake grows.

In the digital age, equity crowdfunding has democratized the investment landscape. Platforms like Kickstarter or Indiegogo allow individuals to invest in startups and small businesses in exchange for equity. It’s like being a venture capitalist from the comfort of your own home.

Investing in equity is not without risks. Stock prices fluctuate and companies may face downturns. However, the potential rewards are equally compelling. Historically, the stock market has shown a propensity to grow over the long term, presenting opportunities for equity holders to see their investments appreciate.

Zooming into personal finance, equity plays a pivotal role in determining your net worth. Your home, investments and even your car contribute to your personal equity. Understanding this can help you make informed financial decisions and build wealth over time.

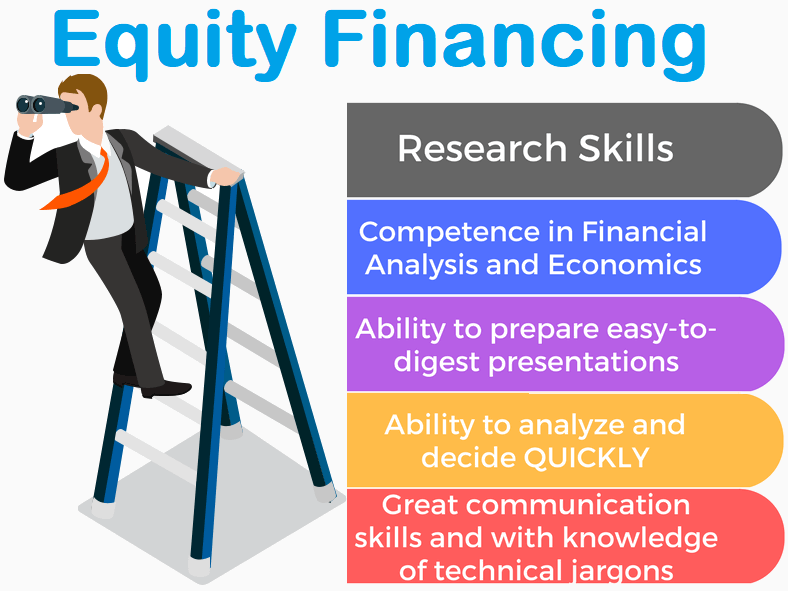

Equity analysts are the detectives of the financial world. They scrutinize companies, economic trends and market conditions to provide insights on potential investments. These professionals help investors navigate the complex landscape of equities, offering recommendations based on thorough analysis.

FAQs: Your Burning Questions about Equity in Finance

Q1: How do I calculate my equity in a property?

A: To calculate your equity in a property, subtract the outstanding mortgage balance from the property’s current market value.

Q2: Can I lose all my equity in a stock? A: Yes, the value of stocks can decline and in extreme cases, you may lose the entire value of your equity investment. Diversifying your portfolio helps mitigate this risk.

Q3: What’s the difference between equity and equality?

A: Equity in finance refers to ownership or value while equality relates to fairness and impartiality. They are distinct concepts but share linguistic similarities.

Q4: How does equity crowdfunding work?

A: Equity crowdfunding allows individuals to invest in startups or small businesses in exchange for equity. It’s a way for entrepreneurs to raise capital from a broad base of investors.

Equity in finance is a multifaceted concept that spans various aspects of our financial lives, from investing in stocks to owning a home. It’s the thread that weaves through the fabric of ownership, connecting individuals to the businesses and assets they hold dear. As you embark on your financial journey, understanding equity provides a compass to navigate the dynamic landscape of finance.

So whether you’re eyeing the stock market, contemplating a real estate investment or simply curious about your personal net worth, remember – equity is not just a term; it’s the heartbeat of financial ownership.